Ark7 is an actual property funding platform that has gained reputation lately. It gives buyers the chance to personal shares in income-producing properties with out the trouble of being a landlord or coping with the complexities of conventional actual property investing. On this complete Ark7 overview, I’ll take a more in-depth take a look at Ark7 and look at if it’s value your time.

.wp-review-35098.review-wrapper { font-family: ‘Open Sans’, sans-serif; }

Ark7 Abstract

The Dinks Ark7 Abstract

Ark7 is a fintech start-up with cell and browser functions. The corporate buys rental property with an LLC and points shares to buyers. Ark7 then takes a administration charge and manages every property on behalf of its buyers. The corporate is new however well-suited for risk-tolerant buyers who desire a geographically centered investing technique.

Execs

- Extremely particular geographic alternatives

- Sturdy operational self-discipline

- Consumer pleasant interface

- Low investing minimums

- Good high quality alternatives

- Aggressive returns

Cons

- New platform

- Lack of managerial management

- Loss threat

- Lack of leverage

- Much less tax flexibility

.wp-review-35098.review-wrapper {

width: 100%;

float: left;

}

.wp-review-35098.review-wrapper,

.wp-review-35098 .review-title,

.wp-review-35098 .review-desc p,

.wp-review-35098 .reviewed-item p {

shade: #555555;

}

.wp-review-35098 .review-title {

padding-top: 15px;

font-weight: daring;

}

.wp-review-35098 .review-links a {

shade: #26af1a;

}

.wp-review-35098 .review-links a:hover {

background: #26af1a;

shade: #fff;

}

.wp-review-35098 .review-list li,

.wp-review-35098.review-wrapper {

background: #ffffff;

}

.wp-review-35098 .review-title,

.wp-review-35098 .review-list li:nth-child(2n),

.wp-review-35098 .wpr-user-features-rating .user-review-title {

background: #26af1a;

}

.wp-review-35098.review-wrapper,

.wp-review-35098 .review-title,

.wp-review-35098 .review-list li,

.wp-review-35098 .review-list li:last-child,

.wp-review-35098 .user-review-area,

.wp-review-35098 .reviewed-item,

.wp-review-35098 .review-links,

.wp-review-35098 .wpr-user-features-rating {

border-color: #26af1a;

}

.wp-review-35098 .wpr-rating-accept-btn {

background: #26af1a;

}

.wp-review-35098.review-wrapper .user-review-title {

shade: inherit;

}

.wp-review-35098.review-wrapper .user-review-area .review-circle { top: 32px; }

{

“@context”: “http://schema.org”,

“@kind”: “Evaluation”,

“itemReviewed”: {

“@kind”: “SoftwareApplication”,

“identify”: “Ark7”,

“picture”: “https://www.dinksfinance.com/photos/2023/05/ark7-logo.jpg”,

“url”: “https://ark7.sjv.io/k0o0Gz”

},

“reviewRating”: {

“@kind”: “Ranking”,

“ratingValue”: 0,

“bestRating”: 100,

“worstRating”: 0

},

“creator”: {

“@kind”: “Individual”,

“identify”: “James Hendrickson”

},

“reviewBody”: “Ark7 is a fintech start-up with cell and browser functions. The corporate buys rental property with an LLC and points shares to buyers. Ark7 then takes a administration charge and manages every property on behalf of its buyers. The corporate is new however well-suited for risk-tolerant buyers who desire a geographically centered investing technique.”

}

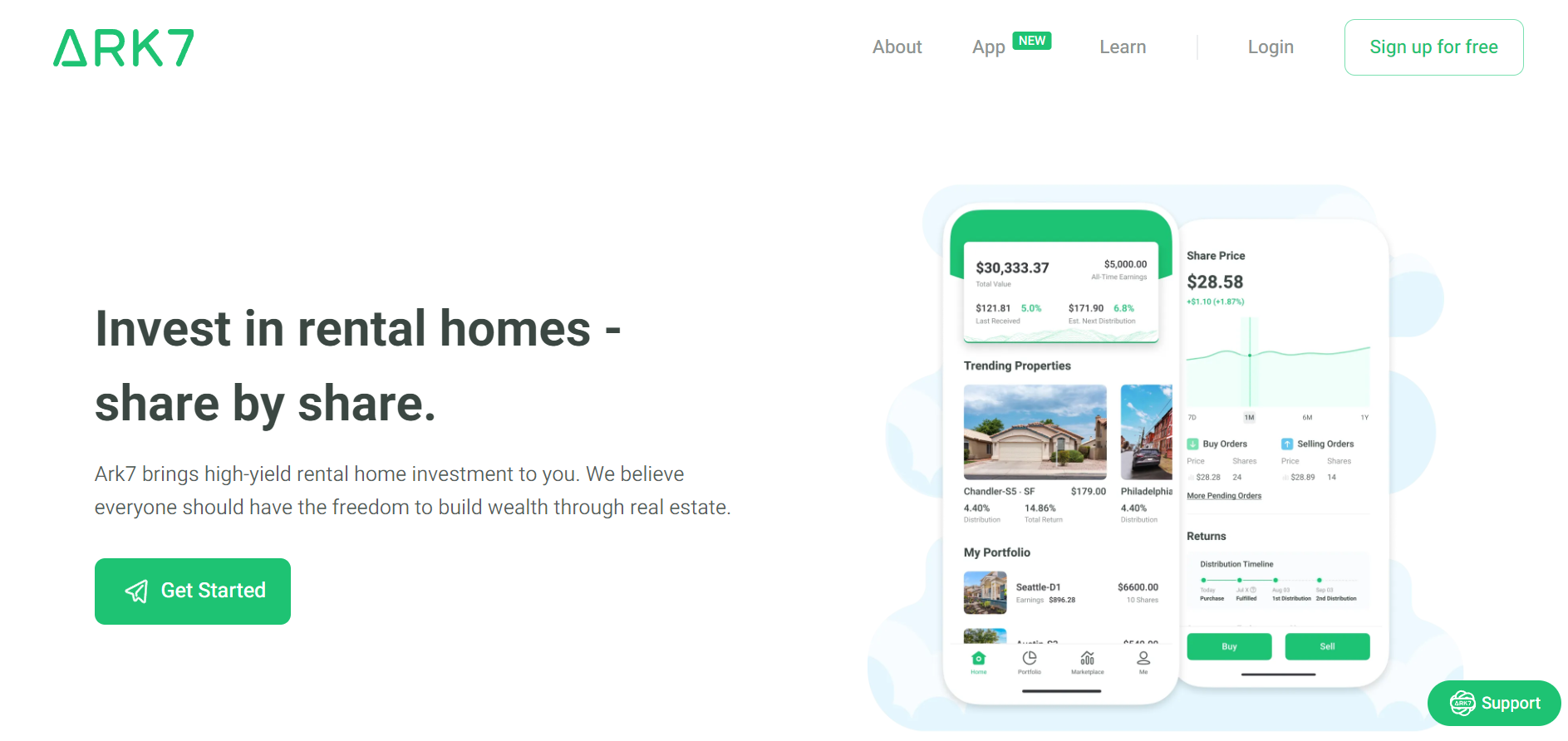

Understanding Ark7: A Temporary Overview

Actual property investing has lengthy been thought of probably the greatest methods to construct wealth and generate passive revenue. Nevertheless, for many individuals, investing in actual property is out of attain resulting from excessive transaction prices and vital paperwork necessities. Ark7, at its core, is an answer to this downside. It permits buyers to entry actual property markets with out requiring massive quantities of capital.

Ark7 is an actual property crowdfunding platform that was based in 2017 to democratize actual property investing. The platform permits on a regular basis buyers to entry high-quality actual property offers that have been beforehand solely obtainable to excessive socioeconomic standing or institutional buyers. Whereas the platform has charges and is much less versatile from a taxation standpoint, it’s appropriate for buyers who need to put money into a focused geographic method.

What’s Ark7?

At its core, Ark7 is a platform that permits buyers to buy fractional shares in properties. What Ark7 does is purchase a property, put it beneath a company umbrella and subject shares within the company. Because of this buyers can personal shares in a company that owns a property, moderately than having to buy your entire property themselves. By pooling their assets with different buyers, people can put money into high-quality actual property offers that they might not have been in a position to entry on their very own.

At its core, Ark7 is a platform that permits buyers to buy fractional shares in properties. What Ark7 does is purchase a property, put it beneath a company umbrella and subject shares within the company. Because of this buyers can personal shares in a company that owns a property, moderately than having to buy your entire property themselves. By pooling their assets with different buyers, people can put money into high-quality actual property offers that they might not have been in a position to entry on their very own.

Ark7 was based by Andy Zhao (an ex-Google engineer), James Weng, and Lynn Yang who acknowledged the potential of actual property investing for constructing wealth and producing passive revenue. They wished to create a platform that may permit on a regular basis buyers to entry actual property markets with extra ease and decrease price than present markets allowed for.

How Does Ark7 Work?

Ark7 is a fintech start-up with cell and browser functions. Ark7 buys rental property beneath an LLC and points shares in that LLC that promote at various costs primarily based on the underlying financial worth of the property.

Share costs are decided by the property’s worth and might differ an ideal deal throughout markets. Ark7 permits the securities to be traded and has choices for holding your funding in an IRA.

Once you purchase shares within the LLC, you obtain part of the month-to-month property revenue proportionate to the share you personal. For instance, should you owned 10,000 shares in a property and there have been 20,000 shares excellent, you’d be entitled to 50% of the revenue, much less charges.

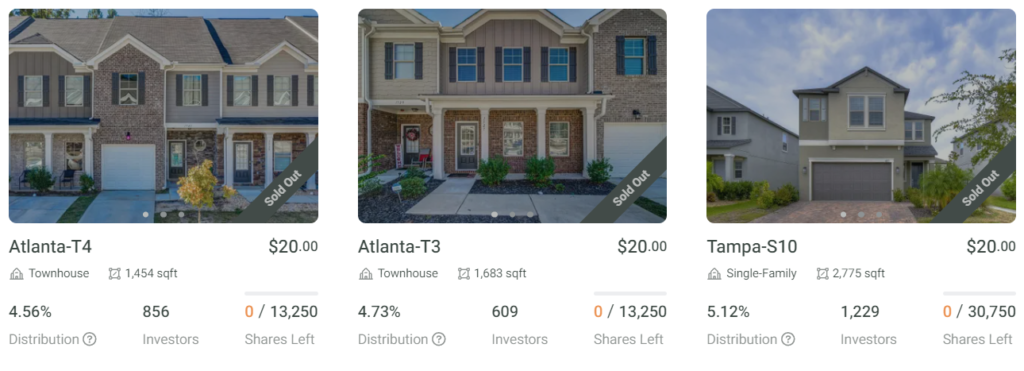

Rental properties listed on Ark7 are positioned in numerous actual property markets and cities across the nation. Ark7 is energetic in ten states with an excellent quantity of market information for app customers to overview. The corporate requires a three-month minimal maintain on its properties. Customers are supplied a really consumer-friendly consumer change to peruse, analyze, and purchase into properties, in addition to monitor the investments they make and monitor dividend funds. The corporate signifies it has near 90,000 energetic customers, pays out $1.4 million in dividends month-to-month and its portfolio is value round $19 million. Its securities are registered with the SEC.

Ark7 is a full-service group. The corporate manages all the true property, together with accumulating lease and coping with any essential property administration and upkeep. For these companies Ark7 expenses between 8% and 15% of the rental revenue. Ark7 gives retirement accounts and alternatives for accredited buyers.

Key Options of Ark7

As an rising fintech, Ark7 has some options that different fractional possession of actual property corporations don’t. These are: providing extremely particular funding opportunities and a excessive diploma of operational self-discipline.

Extremely Particular Funding Alternatives

One of many key options of Ark7 is the extremely particular funding alternatives that it gives to buyers. The platform gives entry to a variety of several types of properties, from single-family properties to multi-unit residence buildings. This variety of funding choices permits buyers to tailor their portfolios to satisfy their funding objectives and threat tolerance.

One of many key options of Ark7 is the extremely particular funding alternatives that it gives to buyers. The platform gives entry to a variety of several types of properties, from single-family properties to multi-unit residence buildings. This variety of funding choices permits buyers to tailor their portfolios to satisfy their funding objectives and threat tolerance.

Tailoring funding objectives and threat tolerance often means diversification, however not at all times. In contrast to different REITs or fractional possession apps, Ark7 permits budget-conscious buyers to make extremely focused investments.

For instance, if an investor felt that single-family properties in Texas have been prone to outperform different asset courses, they’d be capable of execute a method round this utilizing Ark7. In distinction, corporations equivalent to Fundrise, which subject shares in a pool of property, should not in a position to present this degree of exactness.

Very Good Operational Self-discipline

Ark7 workout routines a excessive diploma of self-discipline in its inner operations. For instance, for every property within the Ark7 market, the corporate will take a look at over 1,000 attainable alternatives. Ark7 often makes use of three components to guage alternatives: the presence of huge socioeconomic improvement, inhabitants development, and pro-growth home insurance policies.

Ark7 additionally completely vets native actual property market circumstances and communities across the candidate property. Its crew seems to be for nicer properties in communities with good accessibility, good public faculties, and a satisfying look. It additionally seems to be at neighborhood comparables, equivalent to native rental charges, and native insurance policies on renting, zoning, and different pure components (Coinmonks.com).

Along with extremely centered investments and good operational self-discipline, Ark7 has a number of different benefits.

Consumer-Pleasant Platform

In distinction with competing apps equivalent to HappyNest, the Ark7 platform is straightforward to make use of and navigate, making it accessible to a variety of buyers. The platform can also be well-designed, with clear and concise details about every property and the funding alternative it presents. The consumer interface is intuitive, and buyers can simply monitor their investments and the revenue generated.

Investing in actual property may be difficult, however Ark7 makes it easy. The platform gives buyers with all the data they should make knowledgeable funding selections, and the consumer interface is designed to be user-friendly and accessible to everybody.

Utilizing Ark7

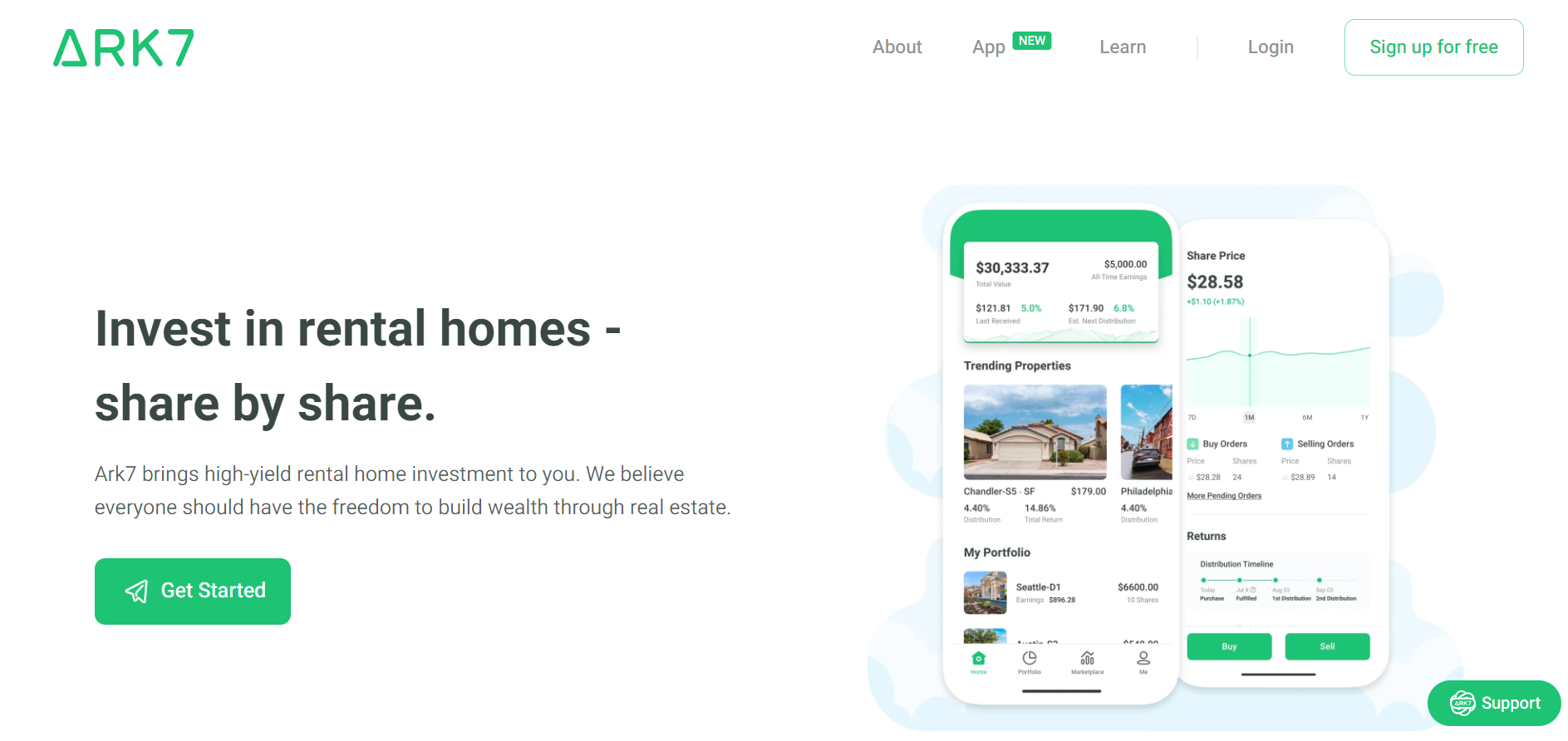

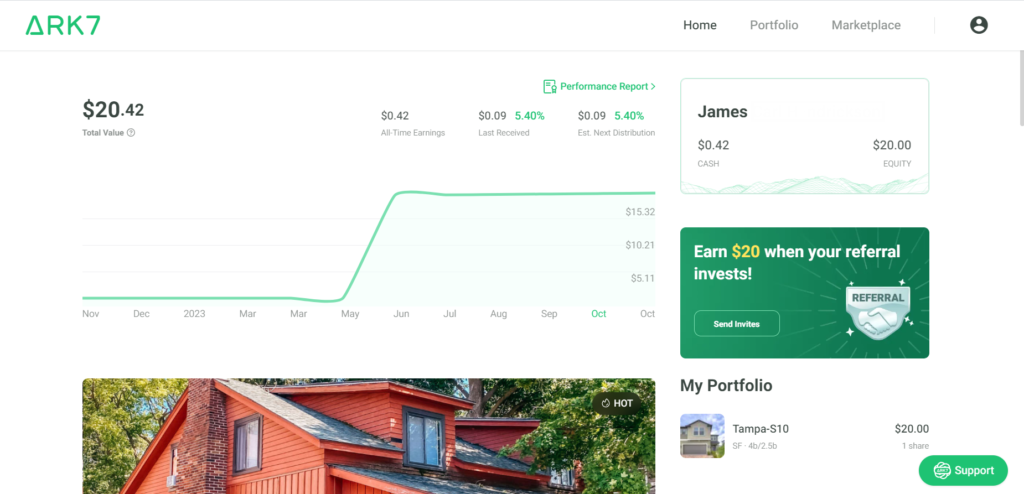

After you open an account you’ll get a dashboard that appears like this.

The dashboard reveals you a bunch of properties, in addition to the price of a share, your complete portfolio overview, and a few tabs to entry {the marketplace} and your portfolio. Once you click on on a property it offers you details about its location, circumstances, share pricing, and money distribution information.

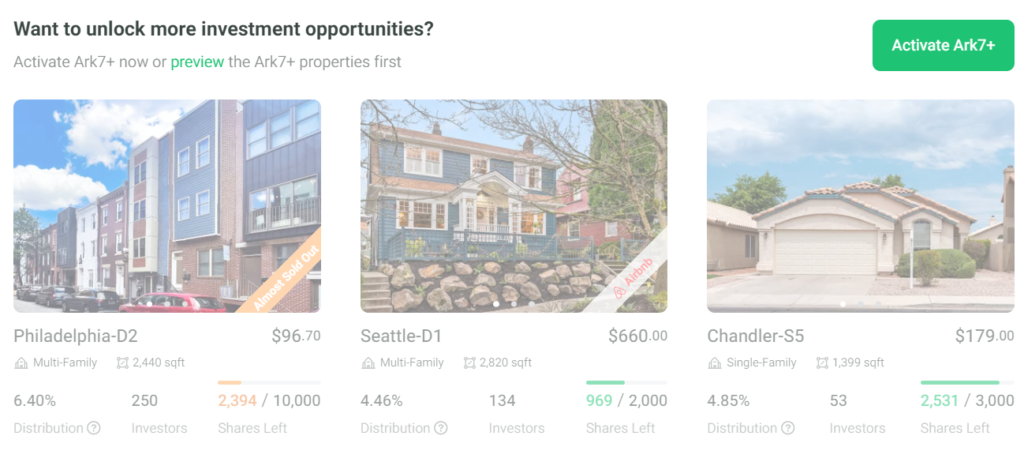

Most of what’s obtainable to retail buyers on the platform are single-family properties. To get entry to business and multifamily properties, you’ll must be an accredited investor. Ark7’s channel for accredited buyers is named Ark7+. The Ark7+ accredited investor alternatives are greyed out till you apply, see right here:

Normally, their interface is straightforward and well-designed. Cash deposited is credited promptly.

Good High quality Investments

One of many largest benefits of utilizing Ark7 is the entry it gives to good-quality actual property investments. The properties within the Ark7 app are all usually newer, well-maintained properties in good neighborhoods. You’re not shopping for trailer parks or $500 homes in Detroit.

Diversification

Most fractional possession actual property apps supply diversified actual property investments. Ark7 isn’t any exception. It gives a diversified portfolio of actual property investments, decreasing the chance of anyone property underperforming. This diversification gives buyers with extra stability and safety of their investments. Furthermore, buyers can select from a variety of funding choices, together with long-term holds, short-term flips, and extra.

Returns: How A lot Does Ark7 Pay?

Ark7 generates revenue for buyers in two methods:

- month-to-month lease funds

- capital positive factors.

As of the time of this writing, listed properties on the Ark7 market have been paying annualized lease funds of between 4.5% and seven.3%, and capital positive factors appreciation charges between 4.1 and 20.7%.

In Ark7 each sources are basically passive for buyers. Whereas some effort is required to pick out and monitor investments, in addition to talk with the Ark7 crew, small buyers don’t must spend a lot time past some preliminary due diligence and ongoing investing monitoring.

Ark7 additionally gives IRA choices. Their IRA choices permit your returns to develop in tax-advantaged accounts. This will increase the true returns of the funding as a result of the impression of taxation on earnings is lessened or eradicated. With Ark7 the accounts are held in custody for you. You maintain the property within the account since you aren’t concerned within the day-to-day administration of the businesses working your properties – making them appropriate for being held in an IRA.

Referral Program

Since Ark7 is in a development section, they’ve a beneficiant referral program. In the event you enroll, you’ll be able to decide up some more money by getting a good friend to hitch — you’ll each get $30. Thirty {dollars} isn’t quite a bit, however once you consider a few years of extra passive revenue the $30 provides you, it begins to look value it. You’ll be able to enroll right here.

Since Ark7 is in a development section, they’ve a beneficiant referral program. In the event you enroll, you’ll be able to decide up some more money by getting a good friend to hitch — you’ll each get $30. Thirty {dollars} isn’t quite a bit, however once you consider a few years of extra passive revenue the $30 provides you, it begins to look value it. You’ll be able to enroll right here.

Potential Drawbacks of Ark7

Ark7 has a number of potential drawbacks.

The Platform is New

Ark7 was based in 2019. Operating a high-growth fintech startup is notoriously troublesome. About 80% of fintech startups fail throughout the first 15 years of enterprise operation. And, whereas Ark7 is a comparatively new investing platform with an attention-grabbing enterprise mannequin, it has not but stood the check of time.

Lack of Managerial Management

One potential disadvantage of utilizing Ark7 is the shortage of management that buyers have over their investments. As fractional house owners, buyers have restricted management over the underlying property and its administration. This lack of management could also be a priority for some buyers preferring to have extra management over their investments.

Danger of Capital Loss

As well as, whereas Ark7 gives a diversified portfolio, there’s nonetheless a threat of loss related to actual property investments. Actual property values can fluctuate, and surprising occasions equivalent to pure disasters or financial downturns can negatively impression the efficiency of actual property investments. Traders needs to be conscious that Ark7 investments might lose as much as 100% of their worth.

Lack of Leverage

Conventional actual property investing permits house owners a excessive diploma of leverage. Take for instance the case of a house owner who buys a home for $100,000 and places down $20,000. If the worth of the home grows to $150,000, the house owner has acquired an funding return of 250%. The quantity of leverage an Ark7 share gives is unclear because the platform remains to be new, nevertheless, it’s possible lower than instantly proudly owning actual property.

Unclear If You Can Borrow Towards Your Ark7 Shares

One benefit of conventional actual property is the flexibility to borrow and use your actual property as collateral. Borrowing is the precept underlying mortgages, dwelling fairness strains of credit score, and the like. The power to borrow is non-trivial. Many high-net-worth buyers can develop their actual property portfolios aggressively and rapidly utilizing leverage. Nevertheless, it isn’t clear if that is an possibility with Ark7.

Much less Taxation Flexibility

Funds from Ark7 are taxed as LLC partnership revenue, per Ark7. That is barely much less versatile than the taxation of REIT distributions, which may be thought of peculiar revenue, capital positive factors, or return of capital (Reit.com). As well as, Ark7 shares don’t have as many tax benefits as instantly proudly owning actual property such because the deductibility of curiosity and property tax funds.

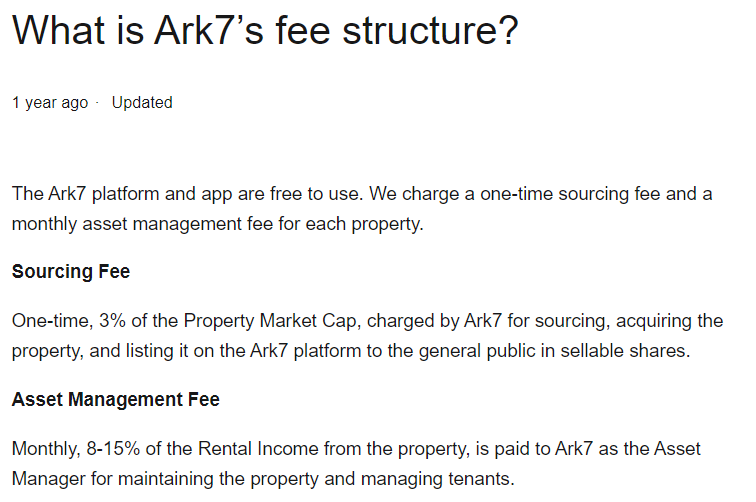

Charges and Pricing Construction

The platform expenses buyers a one-time sourcing charge of three%, which is deducted from the rental revenue generated by the properties by which they’ve invested. This charge covers the price of managing the properties, together with property upkeep, tenant administration, and different administrative duties. Ark7 additionally expenses between 8% and 15% month-to-month for administration charges. In addition they cost an annual charge for IRS accounts.

Right here is the charge construction from its webpage.

You will need to be aware that buyers could also be topic to different charges, equivalent to a documentation charge or transaction charge. These charges are usually charged when buyers make a transaction on the platform, equivalent to once they put money into a brand new property or once they withdraw funds from their accounts.

Ark7 additionally expenses annual charges for his or her IRAs. This can be a $100 custodial charge, per property, per 12 months. Ark7 will waive the charges in case your IRA stability is greater than $100,000 and caps the charge at $400 per 12 months.

Ark7’s charges typically decrease the platform’s return on fairness. Nevertheless, these charges are corresponding to charge buildings charged by realtors and administration corporations. On this regard, they possible mirror the underly unavoidable financial prices of proudly owning and working actual property. Tenants must be screened, properties must have home equipment up to date, roofs repaired, and so on.

What are Ark7’s Lengthy-Time period Prospects?

Whereas the fintech actual property house is extraordinarily aggressive, Ark7 is effectively funded.

Any potential investor Ark7 might marvel if the platform can be round within the subsequent 5 to 10 years to ship on the returns buyers are anticipating. On this regard, Ark7 is well-funded. It acquired two tranches of funding one in all $2,000,000 in 2019 (Crunchbase) and one in all $9,000,000 in 2022 (Pitchbook). Whereas actual figures should not obtainable, Ark7 has possible bought at the very least over an extra $1,000,000 value of securities. As well as, Ark7 expenses administration charges on the $19 Million value of property it manages.

Briefly, the corporate seems well-funded and has a cash-generating enterprise mannequin. This means it is going to be round for the medium to quick time period.

Is Ark7 Proper For You?

On the entire, Ark7 is an efficient match for risk-tolerant buyers who’re involved in passive geographically focused actual property investments.

Relative to its rivals, Ark7 gives high quality investments in geographic actual property. It’s nevertheless a more moderen platform. Along with market threat, rate of interest threat, and asset dangers, buyers tackle the added threat of investing by means of a brand new platform with unproven longevity.

Nevertheless, actual property as an asset class is mostly fascinating. In the event you’re searching for a method to generate a gentle passive revenue stream from actual property investments, then Ark7 could also be an excellent match for you. Nevertheless, should you favor extra management over your investments or are searching for larger returns, it’s possible you’ll need to think about different choices.

Finally, whether or not or not Ark7 is best for you will rely in your particular person funding objectives and threat tolerance. In the event you’re searching for much less dangerous returns, it’s possible you’ll need to think about a REIT index fund. Nevertheless, in case you are risk-tolerant and desire a low-maintenance method to make concentrated investments in actual property and generate passive revenue, Ark7 is a good possibility.

Enroll For Ark7

Signing up with Ark7 is straightforward. Just about all that’s required is a US checking account and a social safety quantity. The method is rather like opening a checking account — it’s essential to fill out a few types and supply your handle and different figuring out info. A easy account will get you entry to Ark7’s single-family dwelling investments. You want to be an accredited investor to get entry to their multifamily and business listings.

You’ll be able to join Ark7 right here, or click on on the button under.

Ark7 Evaluation: Backside line

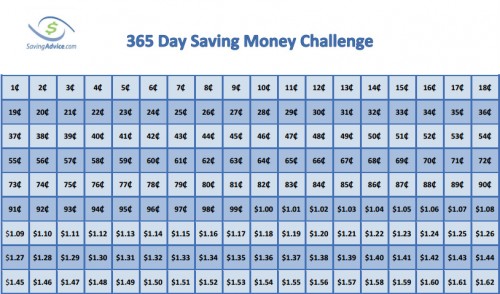

Ark7 is a respectable platform that lets risk-tolerant buyers passively put money into actual property for as little as $20.

The charges you pay once you use Ark7 may be excessive, which might cut back your potential returns. You additionally must maintain your cash invested for a minimal holding interval, between three months and a 12 months.

Nevertheless, the platform is revolutionary, attention-grabbing, and well-suited for buyers who desire a focused actual property technique.