Jamie Golombek: You may declare these bills in the event you work from home however for skilled not private causes

Evaluations and proposals are unbiased and merchandise are independently chosen. Postmedia could earn an affiliate fee from purchases made by means of hyperlinks on this web page.

Article content material

Tax season is now underway, and in the event you moved in 2024, chances are you’ll be entitled to put in writing off your transferring bills, assuming you qualify. Not all strikes, nevertheless, qualify as an “eligible relocation,” and the flexibility to deduct transferring bills could be challenged by the taxman, which is what occurred in a current case determined earlier this month. However earlier than delving into the main points of this newest case, let’s briefly evaluate the principles for deducting transferring bills.

Commercial 2

Article content material

Article content material

Article content material

Below the Earnings Tax Act, you’ll be able to deduct transferring bills for an eligible relocation, which is a transfer that permits you to work (or to attend college) at a brand new work location, supplied the transfer brings you not less than 40 kilometres nearer to your new work (or college) location. The bills could be deducted from the revenue you earned at your new work (or college) location.

However can you will have eligible relocation if you find yourself working from residence, and proceed to work out of your new residence, such that your transferring bills are tax deductible?

That was the difficulty on this current case involving an Ontario taxpayer who claimed almost $67,000 of transferring bills on her 2021 tax return for a transfer she made in early February of that yr. The Canada Income Company denied her declare for transferring bills, and he or she took the matter to Tax Court docket.

Within the years at concern, the taxpayer was employed as a territory account supervisor for a expertise firm who was answerable for promoting the corporate’s software program and technical providers. She spent most of her time interacting in conferences with potential and present prospects. Previous to the pandemic, she labored primarily from the corporate’s Toronto workplaces, however this modified in March 2020 when the company workplaces have been closed due to the COVID-19 pandemic, and he or she started working from her residence in Mississauga.

Article content material

Commercial 3

Article content material

As soon as she started working from residence, her buyer conferences have been typically performed just about. This introduced a number of challenges, as she lived together with her husband and two younger sons on the highest ground of their residence and rented out her basement to her sister and her household. She didn’t have a personal workplace area in her Mississauga residence and located that she was usually distracted by “the rambunctious actions of her two boys, who usually interrupted her buyer conferences.”

The taxpayer’s compensation construction consisted of a mixture of wage and fee, which was based mostly on her gross sales. She thought-about her gross sales targets to be excessive, and famous that as she met them, her targets for the next yr subsequently elevated. She fearful whether or not she would be capable of attain these new targets the next yr given the challenges she skilled in working from her Mississauga residence.

Because of this, within the fall of 2020, the taxpayer and her husband began to search for a brand new residence, ultimately discovering one in Campbellville, which was about 40 kilometres from her Mississauga residence. The taxpayer and her household moved into the brand new residence in February 2021. The brand new residence had a basement, which she might use as a personal workplace, and a a lot bigger out of doors area the place her youngsters might play and thereby occupy their time. She testified that the additional out of doors area additionally allowed her to rent a instructor for the kids to allow them to be taught extra about nature and additional occupy their time whereas she was working from her residence workplace.

Commercial 4

Article content material

Whereas the taxpayer acknowledged that the Mississauga residence additionally had a basement, which she might have used as a personal workplace, she testified that she was unable to make use of the area because it was being rented to her sister. When finally she did transfer to the brand new residence, her sister and household have been capable of finding appropriate new lodging on their very own.

The decide agreed that the time period eligible relocation within the tax act have to be interpreted in a fashion that acknowledges the truth that, significantly within the post-pandemic work surroundings, many Canadians work at home and, identical to Canadians who work in a extra conventional workplace setting, they need to be capable of entry the advantage of the transferring expense deduction the place acceptable. That being stated, the decide added that it should even be acknowledged that “Parliament didn’t intend for the deduction to be accessible the place an individual relocates primarily for private causes.”

In different phrases, to ensure that the eligible relocation take a look at within the act to not be rendered meaningless the place an individual with a house workplace strikes to a brand new residence with a brand new residence workplace, the taxpayer should be capable of clearly show that the relocation primarily occurred to allow the taxpayer to be employed on the new location, and never for private causes.

Commercial 5

Article content material

Whereas the decide was sympathetic and expressed “little question” that the taxpayer’s new residence supplied her with a greater work surroundings than she had beforehand, he couldn’t settle for that the taxpayer’s major motivation behind the relocation was to allow her to retain her employment. In spite of everything, the taxpayer admitted in cross-examination that at no time did her employer specific any dissatisfaction with the work she was doing whereas understanding of the Mississauga residence or recommend {that a} transfer is likely to be vital for her to retain her employment. She met her targets and was paid the total commissions for which she was eligible.

As well as, the taxpayer was obscure in her testimony as as to if her work at home standing could be momentary. Because the decide famous, it’s a lot much less possible that the relocation of an individual’s residence workplace might be primarily motivated by employment issues, the place such particular person is working from residence on a brief foundation, or in a scenario that’s prone to be momentary.

Really helpful from Editorial

Commercial 6

Article content material

Lastly, the decide famous that each houses had a basement that would have been used as an workplace, and the truth that her sister was dwelling within the Mississauga residence and paying lease didn’t seem like an obstacle to her understanding of her outdated residence and was not an element necessitating her transferring to a brand new residence.

Because of this, the decide was unable to conclude that the taxpayer’s relocation occurred to allow her to be employed working on the new residence for functions of the definition of eligible relocation, and thus her transferring bills weren’t tax deductible.

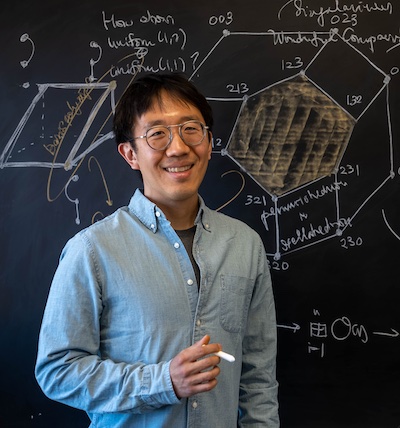

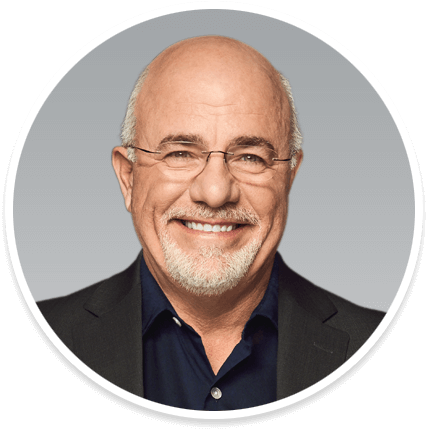

Jamie Golombek, FCPA, FCA, CFP, CLU, TEP, is the managing director, Tax & Property Planning with CIBC Non-public Wealth in Toronto. Jamie.Golombek@cibc.com.

If you happen to favored this story, join extra within the FP Investor e-newsletter.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material