Q.

I’m a 58-year-old surgical nurse retiring in July. My

will likely be roughly $55,000 yearly and it’ll begin paying out in September. I’ve $48,000 in unused

registered retirement financial savings plan

(RRSP) contribution room. Ought to I

on my 2025 taxes? I’ve sufficient saved to take action. Or, ought to I follow topping up my

tax-free financial savings account

(TFSA)?

—Thanks, Richard in Ontario

FP Solutions:

Richard, there are some things to contemplate when deciding on an RRSP or TFSA contribution. One of the best place to start out is with a very good understanding of the mathematics behind RRSPs and TFSAs.

It’s usually stated that RRSP contributions are made with pre-tax cash and TFSA contributions with after-tax cash. Though true by design, it isn’t true based mostly on the way in which most individuals make RRSP contributions.

Most individuals suppose, “I’ve $10,000, ought to I add it to my RRSP or TFSA?” In case you are including to your RRSP you’ll seemingly do it in considered one of 3 ways: you’ll gross up the quantity (which I’ll clarify later), you’ll reinvest the tax refund, or you’ll make investments solely the $10,000.

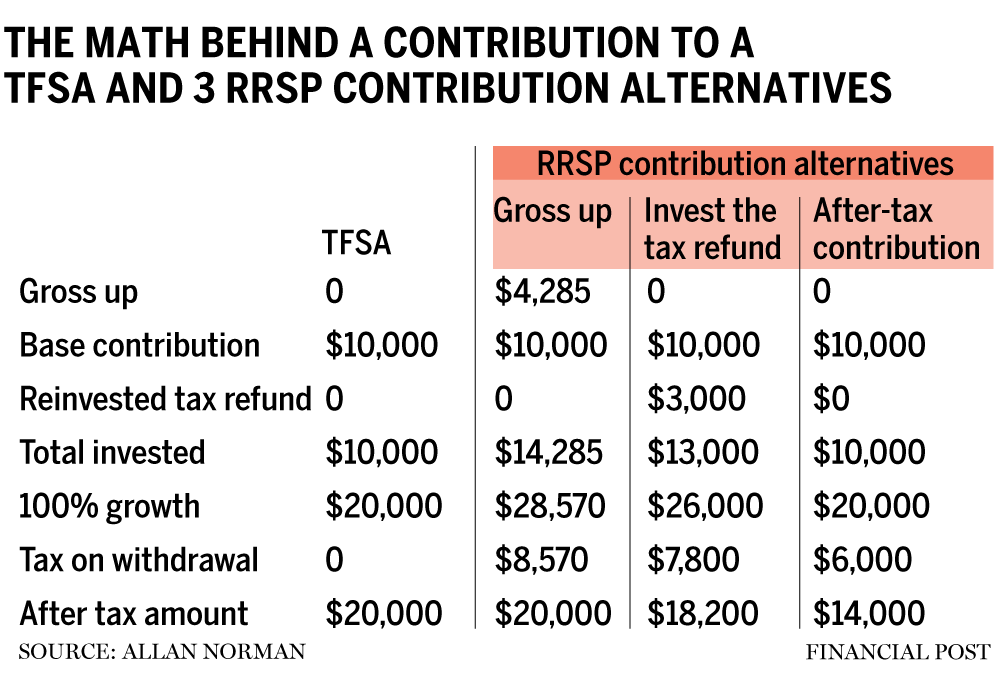

The accompanying desk illustrates the mathematics behind a $10,000 contribution to a TFSA, and three RRSP contribution options. I’m assuming the total contribution and withdrawal is taxed at 30 per cent and the preliminary funding grows by 100 per cent over time.

The leads to the chart are displaying no distinction between TFSAs and RRSPs in case you are grossing up (pre-tax) your RRSP contribution. It’s also possible to infer that if on the time of withdrawal you’re in a decrease tax bracket, the RRSP beats the TFSA and if in a better tax bracket, the TFSA beats the grossed-up RRSP.

Additionally obvious from the desk is that in case you are not grossing up your RRSP contribution the mathematics favours a TFSA contribution.

Grossing up your RRSP contribution means contributing an quantity equal to what you needed to earn earlier than tax, to have $10,000 in your checking account. Right here is the gross up system: $10,000/(1-30 per cent (your marginal tax fee)). To get the additional $4,285 you possibly can both borrow the cash from a lender or from your self after which pay it again whenever you get your tax refund.

Richard, you might be questioning, in case you maximize your $48,000 RRSP contribution how are you going to gross up your contribution? You possibly can’t, however it’s nonetheless essential to grasp the mathematics behind contributions. You want to even be wanting on the different advantages of creating RRSP contributions.

RRSPs and TFSAs are each tax shelters. Nevertheless, you’ll seemingly cease incomes RRSP contribution room when you cease working, whereas every year you’ll earn extra TFSA contribution room. Plus, this can be your highest revenue incomes yr. Primarily based on that it might be finest to maximise your RRSP after which use the tax refund to prime up your TFSA.

Understand that you don’t have to assert all or any of your RRSP tax deduction within the yr you make an RRSP contribution. Your revenue in 2025 will likely be made up of wage and pension and could also be your highest incomes yr till you begin your

(CPP) and

(OAS). You might wish to declare an RRSP deduction to carry your revenue all the way down to the highest of the primary tax bracket and save your remaining RRSP deduction for a future yr or years. For those who determine to do some part-time work the saved RRSP deductions could also be helpful.

One other consideration is that cash inside an RRSP compounds tax-free. The cash you’ve gotten saved to make the $48,000 contribution could also be incomes taxable curiosity, dividends, or capital positive aspects. The longer you’ve gotten the cash in your RRSP the larger this benefit turns into. Now, in case you are planning to spend the $48,000 within the subsequent yr or two you might solely wish to add sufficient to your RRSP to carry you all the way down to the highest of the decrease tax bracket — about your pension revenue — after which prime up your TFSA with the remainder, presumably leaving some non-registered cash.

Richard, as I discussed earlier, RRSPs and TFSAs are each tax shelters and RRSPs have a restricted shelf life in contrast with TFSAs. If that is long-term cash you’ve gotten saved so as to add to your RRSP it might be finest to make use of it whilst you have the upper revenue and save your TFSA room.

Allan Norman, M.Sc., CFP, CIM, offers fee-only licensed monetary planning companies and insurance coverage merchandise via Atlantis Monetary Inc. and offers funding advisory companies via Aligned Capital Companions Inc., which is regulated by the Canadian Funding Regulatory Group. He will be reached at alnorman@atlantisfinancial.ca.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable to know — add financialpost.com to your bookmarks and join our newsletters right here.