When most individuals consider homelessness, they image tents, shelters, or folks sleeping in vehicles. However what they not often see are the months and even years of economic wrestle that led them there.

Homelessness doesn’t normally come from one huge disaster. It’s typically the tip results of a collection of seemingly small cash errors that spiral over time. Missed hire. Unpaid payments. Debt is stacking up silently within the background. Most households don’t get up homeless sooner or later—they get pushed towards it, inch by inch, resolution by resolution.

And the scariest half? It may occur to virtually anybody. Listed below are the seven monetary missteps that may quietly dismantle even probably the most secure households and the way to keep away from them.

1. Residing With out an Emergency Fund

In an ideal world, everybody would have at the very least 3–6 months of bills saved for emergencies. However in actuality, many households reside paycheck to paycheck, leaving them with no buffer when issues go incorrect.

Automotive breaks down? Job loss? Medical disaster? With out an emergency fund, any one in every of these can derail your total funds. And when you possibly can’t pay hire or mortgage, even for one month, your housing is in danger. What begins as one missed cost shortly snowballs into eviction notices, late charges, and authorized motion. By the point households attempt to catch up, it’s already too late.

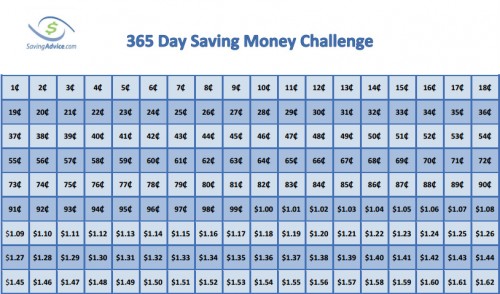

Answer: Even when it’s $10 every week, begin saving one thing. Deal with your emergency fund like a non-negotiable invoice as a result of one disaster shouldn’t imply shedding your property.

2. Counting on One Earnings Stream

In lots of households, one individual earns the majority of the earnings. Whereas this will work high quality throughout secure instances, it leaves your entire household susceptible if that job disappears.

Layoffs, sickness, or incapacity can hit abruptly, and if there’s no second earnings, even quickly, the hire doesn’t wait. Payments nonetheless arrive. Groceries nonetheless must be purchased. And unemployment advantages not often cowl the complete value of residing. When there’s no backup plan, even a short-term earnings loss can drive a household straight into monetary freefall.

Answer: Diversify earnings sources the place attainable. Whether or not it’s a part-time aspect hustle, freelance gig, or passive earnings stream, having a backup makes all of the distinction when the surprising hits.

3. Ignoring Housing Value Creep

One of many greatest errors households make is assuming they’ll “stretch” into a house they’ll’t fairly afford. Lease that eats up greater than 30% of your earnings turns into a ticking time bomb, particularly if it’s tied to variable utilities or unstable earnings.

Worse, when households improve their properties however not their incomes, they depart no margin for error. All it takes is one bump within the street to overlook a cost and set off the eviction course of. And landlords at present are much less versatile than ever. Many gained’t hesitate to file a proper eviction the minute hire is late, no matter your historical past.

Answer: Calculate your housing funds realistically. Don’t max out simply since you’re accredited for extra. Depart room for different necessities, and keep under 30% of your take-home pay when attainable.

4. Utilizing Credit score to Survive As a substitute of Budgeting to Thrive

Bank cards might be helpful instruments, however once they turn out to be lifelines, they slowly dig a monetary grave. Many households fall into the entice of utilizing credit score to make ends meet, masking groceries, fuel, and payments, pondering they’ll pay it off “later.”

However as curiosity piles up, so does the stability. And the minimal cost turns into simply one other expense to juggle. Earlier than lengthy, households are utilizing new playing cards to repay previous ones, whereas falling behind on housing. As soon as the playing cards are maxed and the hire is late, there’s little left to protect them from homelessness.

Answer: Funds brutally. Monitor the place each greenback goes. For those who’re utilizing credit score to outlive, it’s time to chop bills or improve earnings earlier than your roof is determined by it.

5. Skipping Renters Insurance coverage and Tenant Protections

Many renters assume their landlords will handle the whole lot. However when catastrophe strikes—fireplace, flood, or theft—it’s renters who are sometimes left with nothing. With out renters’ insurance coverage, households could lose the whole lot they personal and haven’t any approach to get well.

Worse, some tenants don’t perceive their rights and unknowingly signal leases that give landlords far an excessive amount of eviction energy. In tight housing markets, this error can imply you’re changed with a higher-paying tenant in a matter of weeks.

Answer: All the time carry renters insurance coverage—it’s normally lower than $15 a month. And earlier than signing something, perceive your state’s tenant legal guidelines and your lease’s high quality print. Information is your first line of protection.

6. Ready Too Lengthy to Ask for Assist

Pleasure is highly effective, nevertheless it can be harmful. Many households wait till they’re utterly underwater earlier than asking for assist, whether or not from household, pals, nonprofits, or authorities applications.

However by the point eviction notices arrive, choices are fewer and time is shorter. Charities are sometimes overwhelmed. Rental help has lengthy waitlists. And the authorized course of strikes shortly. Delaying assist can flip a solvable drawback right into a disaster.

Answer: Ask early. Whenever you see the warning indicators—job loss, debt piling up, missed hire—attain out. Native companies, church buildings, and authorized help teams typically have sources if you happen to act quick sufficient.

7. Assuming It Can’t Occur to You

Maybe probably the most harmful mistake is pondering, “That would by no means be us.” Many households reside on the sting and don’t notice how shut they’re to homelessness. With out financial savings, secure earnings, or help methods, they’re only one setback away from shedding the whole lot.

This mindset results in dangerous selections, poor planning, and ignoring early warning indicators. The autumn from stability to wrestle is quicker and steeper than most individuals think about.

Answer: Keep humble, keep ready. Acknowledge how susceptible all households are in at present’s economic system. Plan for the worst whereas working towards the most effective.

Homelessness Is a Course of, Not a Character Flaw

We regularly assume folks turn out to be homeless as a result of they have been irresponsible. However extra typically, it’s the system that failed them, or a collection of tiny monetary missteps that snowballed uncontrolled. A layoff. A medical invoice. A hire hike. A automotive restore. Any one in every of these, with no security internet, can knock a household off its toes.

For those who’re housed proper now, you’re already forward. Use that place to construct a stronger monetary basis. For those who’re struggling, bear in mind: it’s not too late. Most crises are survivable with the fitting help, planning, and consciousness. As a result of on this economic system, the distinction between housed and homeless is commonly only a few choices away.

Have you ever or somebody you already know confronted housing instability? What monetary classes did it train you, and what would you do in another way?

Learn Extra:

Ought to We Cease Telling Poor Folks to “Act Wealthy”?

Debt Disgrace Is Protecting You Poor—Right here’s Learn how to Dismantle It

Riley Schnepf is an Arizona native with over 9 years of writing expertise. From private finance to journey to digital advertising and marketing to popular culture, she’s written about the whole lot underneath the solar. When she’s not writing, she’s spending her time outdoors, studying, or cuddling together with her two corgis.